testing impacts on in-plan roth conversions|benefits of a roth conversion : Brand manufacturer Roth in-plan conversions give them a chance to create retirement income that is tax-free and can help manage their future tax liabilities. How do in-plan Roth conversions work? What sort of. WEBA Viagem (1975) Sinopse. Alexandre Veloso é um rapaz inconsequente e arruaceiro que matou um homem em uma tentativa de roubo. Ao fugir da polícia, é delatado pelo irmão .

{plog:ftitle_list}

Resultado da OnlyFans is the social platform revolutionizing creator and fan connections. The site is inclusive of artists and content creators from all genres and allows them to monetize their content while developing authentic relationships with their fanbase. OnlyFans. OnlyFans is the social platform revolutionizing .

A Roth in-plan conversion lets you take a rollover-eligible distribution from your 401(k) plan and put it into a Roth account in the same plan. Ed Slott: Roth Conversions Especially Attractive Before 2026 The tax- and retirement-planning expert on why a series of phased conversions could make sense if higher tax rates are a.Questions and answers about in-plan Roth conversions. Recent legislation now permits plans to adopt a newly expanded Roth in-plan conversion feature. This new plan feature allows you .The TVA 401(k) Plan allows you to convert your eligible* pre-tax and after-tax contributions to Roth through a Roth in-plan conversion. This gives you the chance to build potentially tax .

vanguard roth in plan conversion

roth money conversion in plan

Roth in-plan conversions give them a chance to create retirement income that is tax-free and can help manage their future tax liabilities. How do in-plan Roth conversions work? What sort of. Have you been tempted to jump on the Roth IRA conversions bandwagon? Check out the pros and cons to see if they make sense for you.

Depending on certain details like your plan participation rate, the amount and type of employer matching, and the after-tax contributions levels in your plan, testing may or may not pass. If you.

To accomplish the Mega-backdoor Roth conversion, the plan agreement must (1) allow after-tax contributions, (2) contain a Roth 401 (k) option or allow in-service distributions, and (3) not rely .

Here are several considerations including possible impacts on future taxes for individuals considering a Roth conversion. You’ll owe income taxes of 10% to 37%, depending on your income tax rate, on all the money you convert from a traditional IRA or a rollover from a 401(k) to a Roth IRA. For those making Roth conversions, you must wait five years after the conversion or until you are at least 59½ before you can withdraw the converted amount without paying the 10% penalty.

To take the first step in the Mega Backdoor Roth conversion process, you must start contributing to the "traditional" after-tax money source in your retirement plan. Not to be confused with the .

The Roth Conversion Explorer is a modeling tool within the NewRetirement Planner. If you are not sure when or if you should do a Roth conversion, you might start with this tool. It will analyze all aspects of your plan, running hundreds of scenarios, to generate a conversion strategy that could increase your estate value at your longevity. If your 401(k) plan was a Roth account, then it can only be rolled over to a Roth IRA. The rollover process is straightforward. The transferred funds have the same tax basis, composed of after-tax . ☐ The Tax Cuts and Jobs Act made Roth conversions irreversible, so you may want to do your Roth conversions later in the year to ensure you understand the full tax-year picture. TIMELINE You open a new traditional IRA in September, make a ,500 non-deductible contribution, and execute a backdoor Roth conversion. Taxation of a Roth IRA Conversion. A Roth conversion occurs when you take savings from a traditional, or pretax, IRA or employer-sponsored retirement plan, such as a 401(k), and convert them to Roth. When converting your pretax savings, you’re including the converted amount as income on your taxes now to get the tax-free growth benefits of a .

Plan requirements for a Mega-backdoor Roth conversion. To accomplish the Mega-backdoor Roth conversion, the plan agreement must (1) allow after-tax contributions, (2) contain a Roth 401(k) option or allow in-service distributions, and (3) not rely on the safe harbor under the non-discrimination rules. For a conversion from a qualified plan to a Roth IRA, or an in-plan Roth rollover, the form should have distribution Code G in box 7. . Be sure to check for the potential impact of Roth conversions using tax software or consulting with a tax professional. Roth conversion ladder. Once a Roth conversion occurs, a five-year period starts, after .By doing Roth conversions early in retirement, that required distribution is reduced. What is a Roth conversion strategy for a 65 year old retiree? Roth conversions may be beneficial for a 65 year old retired person who is delaying Social Security benefits and has a sizeable amount in a pre-tax retirement account such as an IRA or 401(k).

roth ira conversions explained

If you have a Roth option within your retirement plan, you may be able to convert the after-tax 401(k) amounts to a Roth 401(k). This is called an in-plan Roth conversion. Or, if your plan allows it, you may be able to roll your after-tax contributions to a Roth IRA. Prorated earnings attributable to the original contribution can be rolled to .

Roth Conversion Calculator Methodology General Context. The Roth Conversion Calculator (RCC) is designed to help investors understand the key considerations in evaluating the conversion of one or more non-Roth IRA(s) (i.e., traditional, rollover, SEP, and/or SIMPLE IRAs) into a Roth IRA, but it is intended solely for educational purposes – it is not designed to . My annual expenses are around ,000. I plan to take Social Security to 70, I’m guessing 00 a month. I am trying to assess and manage the impact of RMD in taxes. Roth conversions of course, is the only tax lever that I see. Starting in 2022, I plan to do Roth conversions to the top of the 12% bracket from either my 401(k) or IRA account.

A designated Roth account is a separate account in a 401(k), 403(b) or governmental 457(b) plan that holds designated Roth contributions. The amount contributed to a designated Roth account is includible in gross income in the year of the contribution, but eligible distributions from the account (including earnings) are generally tax-free.

A little background: A Roth IRA conversion is the process of moving money directly from a pretax account, such as a traditional IRA or 401(k), to a post-tax account (Roth IRA) and paying the tax . They added Roth in plans for matching, Roth catch-up contributions, 529 to Roth, Roth SEP IRAs, Roth Simple IRAs, all under one big heading in Secure 2.0 called “revenue provisions.” It brings . Now scroll to the far right to cell AC88 or use the find function in your spreadsheet software to locate “Form 8962.” Enter the full price of the second lowest cost Silver plan in cell AE100.Use the annual number here. . Roth conversions are a complex financial planning strategy. For that reason, we always recommend that you consult with a qualified, fed-focused financial advisor and tax professional to assess individual circumstances and tailor a Roth conversion strategy that aligns with your specific retirement goals and objectives before taking any action.

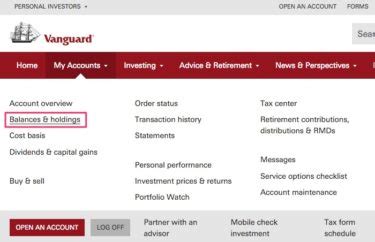

Roth Conversion Amount: On Line 2, enter the total amount you converted from traditional IRAs to Roth IRAs during the tax year. This amount should only include the taxable portion of the conversion. . This can impact the taxable portion of your conversion and the basis calculation. Consulting with a tax professional can help you navigate .earnings as well as contributions in a Roth in-plan conversion. Earnings may occur, . We recommend seeking the advice of a tax professional regarding the impact of taxes on any Roth in-plan conversion. How do I contact Vanguard? You can reach a Vanguard Participant Services associate by calling (800) 523-1188 . A Roth conversion inside your 401(k) plan is when you convert the traditional, pretax balance of your 401(k) money to tax-free money without taking your money out of the plan. If you do this, you will be required to pay ordinary income tax (taxed at your top marginal tax rate) on the conversion balance.. You can pay this amount using a portion of the money in your .VeriPlan allows you to test various alternative plans for future Roth conversions and then choose the plan that is right for you. As a first step, a user might test the breakeven age on a single year future Roth conversion. . Parts B & D IRMAA” column in the expenses section of the VeriPlan Comparison Tool to understand the aggregate impact .

Roth conversions can impact eligibility for income-related benefits such as the ACA Premium Tax Credit (PTC) by increasing taxable income in the year of conversion. Higher income resulting from conversions might reduce eligibility for these benefits tied to income thresholds, potentially affecting subsidies or tax credits. Will a Roth IRA conversion impact your Social Security benefit, or will your Social Security have an impact on how much you can convert to Roth? . The problem is that there’s an earnings test when it comes to Social Security benefits. So Flor, if you’re making more than let’s call it ,000 a year in your quote/unquote “working .The second video demonstrates the lifetime tax and wealth impacts of these optimal Roth contribution and conversion strategies, using Excel based Roth conversion analysis software.This first video is about how to evaluate what you should do with your own lifetime Roth contributions and Roth IRA conversions with respect to federal, state, and local income taxes.Yes, if your plan offers a Roth 401(k) feature and allows in-plan conversions. Of course, taxes may still apply, depending on the source of the balances converted. . Managing the tax impact of a Roth IRA conversion requires careful analysis. A review with a financial or tax advisor is always a good idea.

A Roth IRA conversion shifts money from a traditional IRA or a qualified employer-sponsored retirement plan into a Roth IRA. These conversions are ideal for people who want tax-free investment .

Resultado da 29 de jun. de 2023 · O palpite Estudiantes x Central Córdoba do SDA. O Central Córdoba não tem um bom retrospecto como visitante, mas está invicto há cinco jogos. Enquanto isso, o Estudiantes tem o mando de campo e sofreu apenas uma derrotas nas últimas 19 partidas. Com isso, el león é .

testing impacts on in-plan roth conversions|benefits of a roth conversion